Raising funds but facing roadblocks? Investor approval often hinges on thorough preparation. Missing documents or non-compliance can delay deals and undermine trust. Don’t let due diligence be your stumbling block! This ultimate due diligence checklist for raising funds checklist ensures you're investor-ready with complete, compliant documentation.

Achieve fundraising success effortlessly—follow our guide today!

Why Investors Say No?

Imagine this: A startup with a brilliant product idea secures an investor meeting, but the excitement quickly fades. Why? Missing financial statements, unclear ownership structures, and unresolved compliance issues send the investors running. Stories like this are all too common.

Raising funds isn’t just about having a great pitch; it’s about proving your business is worth the investment. Investors dig deep, from financial health to intellectual property, and even minor red flags can derail a deal.

|

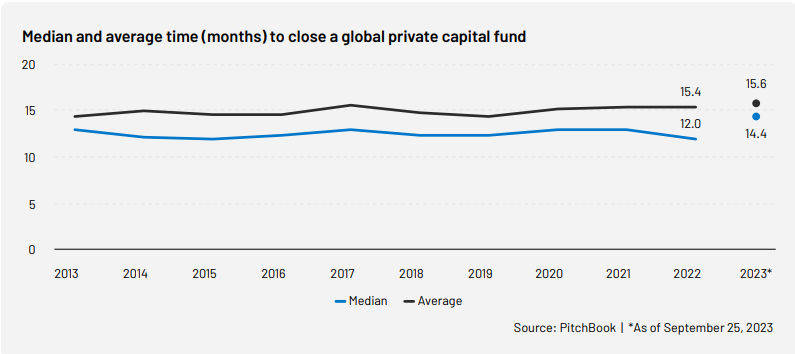

The average time to close private capital funds globally was approximately 15.8 months in 2023, with slower quartiles taking up to 21.1 months. This duration reflects the general slowdown in fundraising due to economic conditions and increased compliance complexities.

|

Whether you’re aiming for angel investors or venture capitalists, the key to success lies in preparation. Thorough due diligence is not just about ticking boxes—it's about building investor trust and making sure your business is ready for the challenges that come with scaling.

Introducing the 5 Ps of Due Diligence

Investors evaluate your startup using a multi-faceted lens to ensure their investment is sound. By focusing on the 5 Ps of Due Diligence, you can align your preparation with what matters most:

- People: Showcase the strength and expertise of your team. Investors prioritize capable leaders who can execute plans effectively.

- Product: Emphasize the uniqueness and scalability of your offering. A product with a competitive edge is more likely to attract funding

- Processes: Ensure your operational workflows are efficient and scalable. Robust processes indicate your business can handle future growth seamlessly.

- Performance: Present clear, accurate financial statements and KPIs. This reassures investors about the stability and growth of your company.

- Projections: Highlight your growth strategies with realistic and well-researched forecasts. Investors look for startups with achievable, data-driven plans.

By addressing these areas, you not only strengthen your due diligence but also build trust and transparency with potential investors.

Mastering the Basics: What is Fundraising Due Diligence

Fundraising due diligence is an essential process where investors assess your startup’s credibility before investing. They dive deep into your business to ensure it’s financially sound, legally compliant, and well-positioned in the market. If you miss any of these critical areas, it can lead to delays or even failed funding rounds.

Key Areas of Due Diligence

- Financial Health: Investors need to see detailed records of your revenue, expenses, and profit margins. Clear, accurate financial statements help investors gauge your profitability and risk level. Without these, your business may appear unprepared. Studies show that 25% of fundraising rounds face delays due to missing or incomplete financial documentation.

- Legal Compliance: This covers everything from valid contracts to intellectual property rights and regulatory adherence. Investors want to ensure you are legally protected and compliant with all relevant regulations. Unclear contracts or potential legal disputes can significantly delay your funding process.

- Market Validation: Your startup's place in the market is critical. Investors look at competitor analysis and your growth potential. They want to understand your unique value proposition and whether there’s room to scale. Outdated or incorrect market research can severely hurt your chances.

- Ownership and Share Structure: Investors look at your team’s expertise and internal processes. Strong operational efficiency shows you can handle scale effectively. Poor team management or inefficient workflows can deter investors from supporting your business.

Fundraising due diligence doesn’t have to be overwhelming. Start with a comprehensive Seed Stage Due Diligence Checklist to ensure you’re covering all critical areas.

Investors Want Clarity—Deliver It

Impress with transparency and readiness in every aspect

Start your prep now

Why Accurate Valuation Matters

An accurate valuation helps set clear expectations for both parties—entrepreneurs and investors. It serves as a foundation for negotiations and reflects the true worth of your company. Over- or under-valuing can create significant hurdles in your fundraising process.

Factors Affecting Valuation

- Revenue Growth: Investors favour startups with consistent and scalable growth metrics. Rapid or steady revenue growth signals that your business is on the right track. According to a report from TechCrunch, businesses with predictable revenue growth are 30% more likely to secure funding.

- Market Potential: A larger addressable market means more growth potential. Startups targeting growing or underserved niches are seen as more valuable. The bigger the market, the more room your business has to expand.

- Intellectual Property: Patents, trademarks, and proprietary technologies increase a company’s valuation by offering a competitive advantage. These assets ensure that no one can easily replicate your product or service, which adds to your marketability.

- Comparable Companies: Investors also look at industry benchmarks. By comparing your business to similar startups in your sector, you can position your company within the expected valuation range. This is crucial to avoid overestimating or undervaluing your startup.

Preparing Your Due Diligence Checklist

Before investors even step into the due diligence process, make sure you have all the right documents in place. The checklist below will help ensure you don’t miss anything important.

Documents to Organize

- Financial Documents: Make sure your balance sheets, income statements, and tax filings are current and accurate. Investors want to see the past 2-3 years of financial data. Delays in presenting these documents can scare off potential investors.

- Legal Contracts: Clear contracts, employment agreements, and intellectual property rights are essential. If your business has any ongoing legal disputes, be transparent and provide documentation related to them.

- Ownership and Equity Distribution: Investors need to know about your competition and market trends. Conduct in-depth research on your target market and competitors. This shows that you understand the landscape and how to position your product or service for success.

- Market Research and Business Model: Provide solid evidence of market demand, your product's competitive edge, and your growth strategy. Share insights into your target market and the competitive landscape.

Key Preparations

- Conduct a Mock Due Diligence: A third-party expert can help identify any gaps in your documentation or areas that need attention before you go to investors.

- Address Potential Red Flags: Proactively resolve any issues related to legal disputes, inaccurate financial data, or unclear ownership structures. By addressing these in advance, you can present a polished and trustworthy image to investors.

- Create a Data Room: A secure, online data room will streamline the due diligence process, allowing investors easy access to all documents. This reduces delays and makes your business appear organized and transparent.

This Investor Due Diligence Checklist ensures you have everything in place before approaching potential investors.

Seal the Deal with Solid Due Diligence

Gain investor confidence with a well-prepared and streamlined process

Check all the boxes today!

The Role of Technology in Simplifying Due Diligence

Due diligence doesn’t have to be a chaotic and time-consuming process. Technology can streamline the entire workflow, allowing you to present your business in the best possible light, while keeping everything organized and transparent. Here’s how.

Tech Solutions to Leverage

- Data Management Platforms: We provide secure platforms to store and share your due diligence documents. Investors can easily access financial statements, legal documents, and other critical files. This improves transparency and saves time while keeping track of investor interactions.

- Valuation Software: We offer integrated tools to help you generate accurate financial projections and business valuations. These tools present a clear picture of your business’s worth, allowing investors to make informed decisions. You can use methods like the Discounted Cash Flow (DCF) model for reliable projections.

- Cap Table Management: Our cap table management system helps track equity distribution and ownership structures. This ensures that your investors clearly understand their stake, reducing confusion and boosting investor confidence.

- Compliance Trackers: Our compliance tracker helps you stay on top of regulatory obligations. It offers timely reminders and ensures your startup meets all legal requirements, which is crucial during due diligence.

By adopting these tools, you can simplify your due diligence process, stay organized, and present your business to investors in a professional and investor-friendly manner.

How Due Diligence Impacts Investor Decisions

Due diligence plays a pivotal role in an investor’s decision-making process. The quality of the due diligence process can directly impact whether they choose to invest or walk away.

Common Pitfalls to Avoid

- Missing or Incomplete Documentation: Incomplete financial records or missing legal documents can cause significant delays. Investors may think you're unprepared or hiding something.

- Lack of Clarity in Ownership Structures: Ownership and equity splits should be clearly defined and easily understood. Ambiguities in this area can make investors hesitant to move forward.

- Outdated Market Research: Use up-to-date data to show how your product fits into the current market landscape. Old or irrelevant market research can make your startup look out of touch.

- Unresolved Legal Disputes: Any ongoing or past legal issues need to be addressed upfront. Investors don’t want surprises, and unresolved legal matters can erode their confidence in your company.

Investors Won’t Say No

Clear documentation, updated research, and strong legal standing make all the difference.

Get due diligence support

Conclusion

Raising funds can be the game-changer for your business needs, but it’s no walk in the park. To make sure you’re not just hoping for the best, prepare your due diligence documentation thoroughly, nail your valuation, and leverage the right tools.

Remember, due diligence is not just about avoiding mistakes—it’s about building trust with potential investors. Make sure you're fully prepared before you meet with investors, and you'll increase your chances of success.

The secret to investor confidence? Trust. Show them you’re ready and reliable, and you’ll transform their hesitation into a resounding "Yes!" Get ready, get prepared, and let success find you.

FAQs

Q. Why is due diligence important before raising funds?

Due diligence is essential because it builds trust with investors by ensuring transparency. It also helps uncover any potential issues that could affect the investment decision.

Q. How do I prepare my business for due diligence?

Prepare by organizing financial records, clarifying ownership structures, updating market research, and ensuring all legal documents are complete and accurate.

Q. What are common due diligence mistakes to avoid?

Avoid incomplete financial records, unclear ownership structures, missing legal documents, outdated market data, and unresolved legal disputes that can raise red flags for investors.

More Questions About Raising Funds?

Our team is here to provide expert answers and guide you through every step of due diligence.

Get on a 1:1 call with us