Why Trademark Registration is Crucial for Your Startup's Growth

Navigating startup fundraising compliance can be daunting, but it's crucial for securing investments. This guide covers key regulations, common challenges, and actionable steps to ensure your startup's compliance. Ready to demystify the process and attract investors?

Dive into our comprehensive guide now!

Let's delve into compliance. It’s all about adhering to the rules and regulations that are essential for any business to thrive. Ignoring compliance can result in fines and penalties. Since laws are frequently updated to close gaps, staying informed is crucial.

For startups, compliance is especially important when securing funding. As a founder, you must ensure investors' money is managed wisely and safely.

Pre seed fundraising and/or venture capital fundraising are pivotal steps in your startup's journey, influencing your company’s growth and success. To navigate this landscape, you need to understand the regulations set by the Company’s Act, Securities and Exchange Board of India (SEBI) and the Ministry of Corporate Affairs (MCA).

While these rules may seem complex, they are vital for smooth and legal operations. This guide aims to simplify these regulations, helping you confidently navigate the fundraising process.

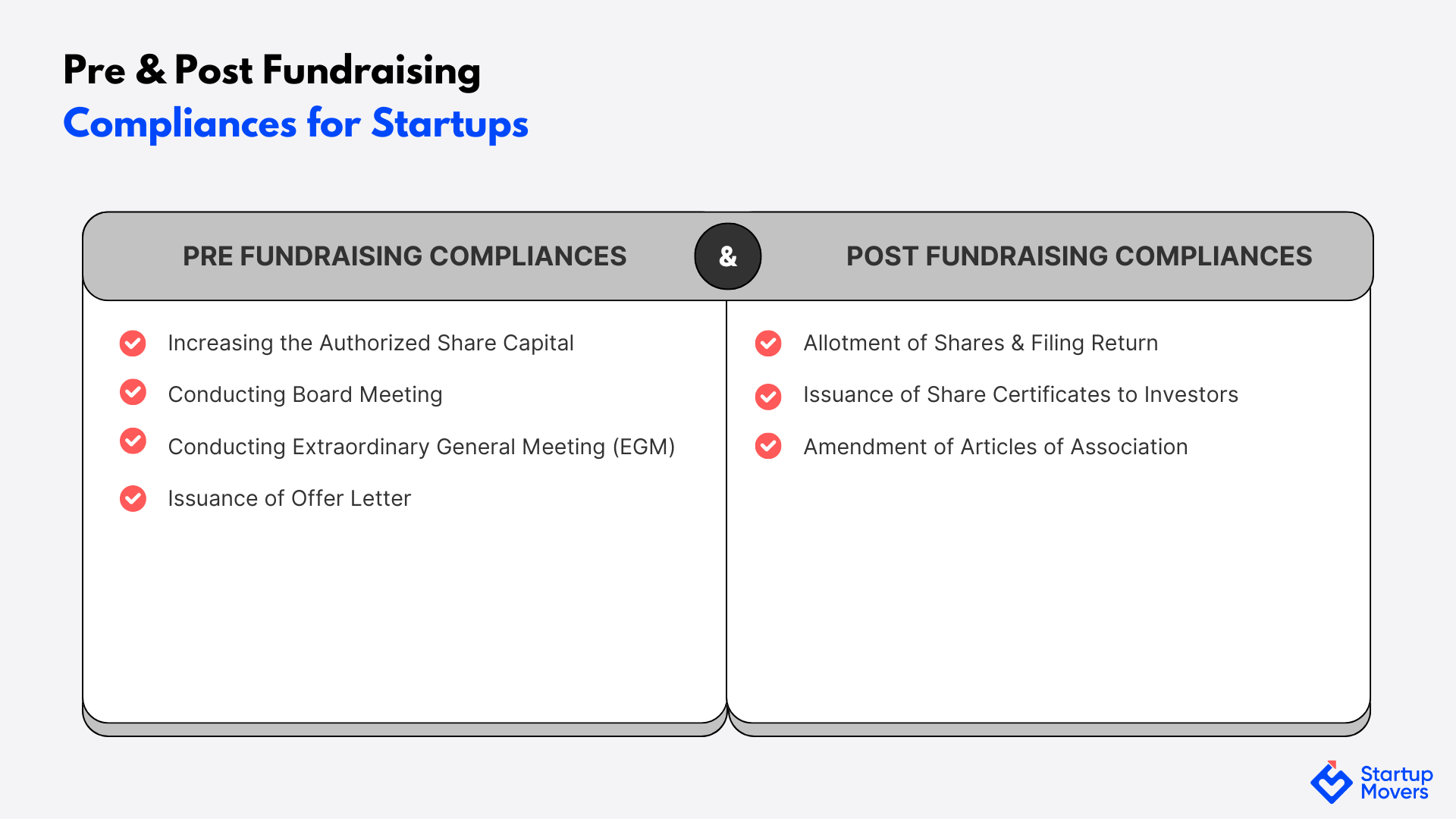

To secure funding in a competitive landscape, it's crucial for startups to meticulously prepare before engaging with potential investors. This includes several key steps including:

After securing funding, it is imperative for your startup to continue adhering to all relevant laws and regulations. This stage of compliance carries numerous responsibilities, including:

Startup fundraising compliance is critical for several reasons:

Navigate Complex Regulations with Ease

Start Your Compliance Journey!Pre-money compliance for startups refers to the set of legal, regulatory, and financial checks and preparations a company undertakes before going through a funding round. The objective is to ensure that the startup is fully compliant with all relevant laws and standards, which makes it more attractive to investors by minimizing their risk. These include:

Startups can raise funds through various methods, such as loans from banks, issuing debentures, or bonds. However, the most popular method today is raising capital by issuing equity or preference shares. This can be done through private placement or preferential allotment of shares.

|

Preferential allotment involves issuing shares to a select group of investors. This method, governed by the Companies Act 2013, is one of the quickest ways to raise funds and increase share capital. |

To increase the authorized share capital, a company must first comply with the Registrar of Companies (ROC). The authorized share capital is the maximum number of shares a company can issue. Investors' subscribed capital cannot exceed this limit. Increasing the authorized share capital is the first step in this compliance process.

A board meeting must be scheduled, and invitations sent to all board members at least seven days in advance. The meeting agenda includes:

An EGM is conducted to pass a private placement offer. During this meeting, a certified true copy of the special resolution, along with forms like MGT-14 and PAS-4, is sent to investors or allottees. This resolution is valid for a period of 12 months from the date of EGM.

Once the board approves the proposal, the company must issue offer letters to investors in the specified formats. Within 30 days of issuing these letters, the company must file a complete record of the preferential allotment with the Registrar of Companies (RoC). Only after this can the company receive funds from investors.

Post-money compliance for startups refers to the set of obligations and regulatory practices that a startup needs to follow after securing funding.

This phase is critical for maintaining the legal and operational integrity of the business, as well as ensuring transparency and trust with investors. These include:

Within 60 days of receiving funds, the company must allot shares to the investors. This allotment must be approved by a resolution of the board of directors. Within 30 days of allotting the shares, the company needs to file a Return of Allotment with the Registrar of Companies (RoC). This return includes details such as the names and addresses of all shareholders, the percentage of shares allotted, and other relevant information.

Another crucial startup fundraising compliance (post-funding) is issuing share certificates. These documents certify the investor's ownership of the company's shares. Once investors receive their share certificates, they officially become shareholders of the company.

If the founders have prepared a Share Subscription Agreement and a Shareholder’s Agreement, the Articles of Association (AOA) must be amended. These agreements typically cover transfer restrictions on issued shares, investor exit rights, vesting schedules, and affirmative voting matters.

Pre & Post Fundraising Compliances for Startups

Startup fundraising compliances in case of foreign investment include:

Startups need to submit this form to the Reserve Bank of India (RBI) after receiving funds from foreign investors. This form includes details such as:

The share issuance must be completed within 180 days of receiving the funds to avoid violating FEMA regulations.

This form, which stands for Foreign Currency-Gross Provisional Return, is required when a company receives Foreign Direct Investment (FDI) and issues shares to a foreign investor.

The company must file details of this share allotment with the RBI within 30 days using the FC-GPR form. Please note that Equity shares, Convertible preference shares and convertible debentures are the only securities considered under FDI.

Click here to view all forms under FEMA.

Non-compliance with the fundraising provision may lead to the company being required to refund all received funds to the investor, along with interest and penalties.

These penalties can impact both the company and its officers, reaching up to Rs. 2 crore. Additionally, it can pose significant problems during due diligence in future fundraising efforts

Navigating startup fundraising compliance is vital for securing investor trust and ensuring smooth operations. By following pre- and post-funding regulations, you protect your startup and position it for growth. Adhering to these measures builds a solid foundation for long-term success.

The investor due diligence process in fundraising involves a thorough examination of a startup's business, legal, and financial records to assess its viability and potential risks. This includes reviewing financial statements, legal documents, business plans, and market conditions.

Investors use this process to verify the accuracy of information provided by the startup and to ensure that it is a sound investment. Key aspects include financial audits, legal compliance checks, and assessment of operational processes.

Post funding compliance for startups involves adhering to legal and regulatory requirements after receiving investment. This includes issuing shares, filing returns with regulatory bodies, and updating corporate documents. Startups must ensure proper reporting to authorities like the Registrar of Companies (RoC) and the Reserve Bank of India (RBI).

Additional compliance also involves regular financial reporting, maintaining good corporate governance, and ensuring tax obligations are met. These steps help maintain investor trust and ensure the startup operates within legal frameworks.

Ensure Legal Security and Investor Confidence with Our Experts!

Schedule a 1:1 call!