Starting a business is like a long journey, with securing seed funding as the crucial first step. This guide will help you understand seed funding in India: its importance, timing, and necessary amounts.

We'll explore pre-seed vs. seed funding, key points, and various funding options available. We'll also cover the Startup India Seed Funding Scheme and more. Registered your startup? If yes, dive in and learn how to grow your business and bring your vision to life!

Seed funding is the initial capital used to start a business. Note that It covers expenses like product development, market research, and team building, amongst others. This early investment helps startups validate their ideas and make progress before generating revenue.

This support helps the startup through its initial stage and helps it grow into a viable business. Hence, it is called 'seed' funding because it is like planting a seed with the potential to develop into a successful venture. Additionally, it involves evaluating the startup’s potential value, which can influence the amount of funding secured.

Seed funding is crucial for startups in India as it provides essential capital for growth. However, equity funding is only available if your startup is registered as a Private limited company. Without this registration, equity funding is not an option.

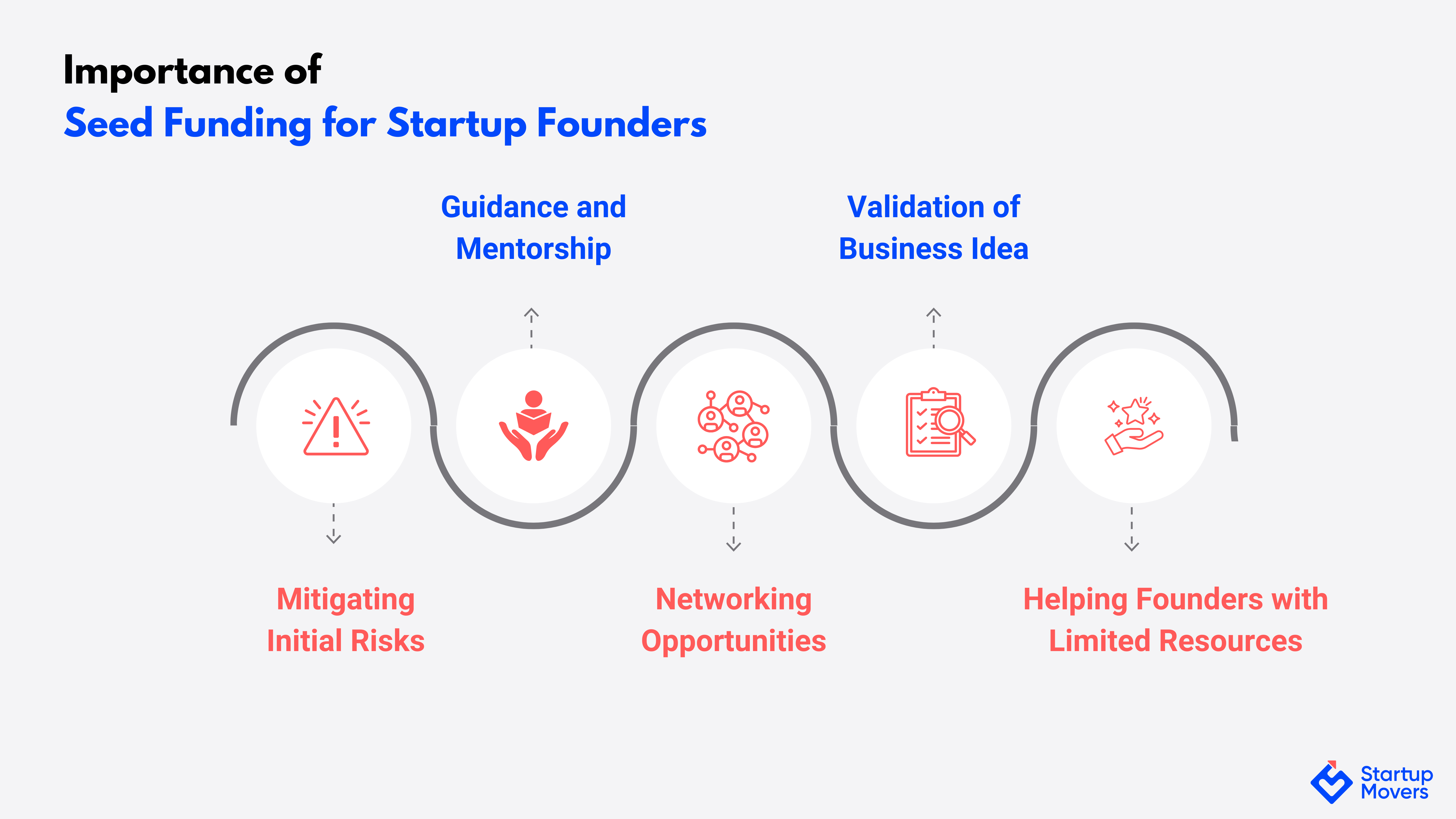

Understanding this can help founders prepare and structure their businesses effectively to secure the necessary funding. Now, let's dive into the benefits of seed funding.

Determining the right time to raise seed funding in India is crucial for a startup’s success. Here are key indicators that suggest it's the right time to seek seed funding:

Raising seed money at the right time can provide the necessary resources to develop your product, validate your market, and set the foundation for future funding rounds.

Determining the right amount to raise as seed funding in India is crucial for a startup’s growth. Here are key points to consider:

Here’s a list of some Indian Startups that raised Seed Funding in India in 2024:

|

Name |

Industry |

Amount (USD) |

Date of Funding |

|

Pointo |

EV, Energy |

$742,934 |

May 2024 |

|

Dexif |

Finance, Blockchain |

$4,000,000 |

May 2024 |

|

ONO |

Agriculture, Logistics, Data |

$1,318,119 |

April 2024 |

|

EyeMyEye |

E-commerce, Retail, Consumer Goods, Fashion, B2C Software |

$2,494,546 |

April 2024 |

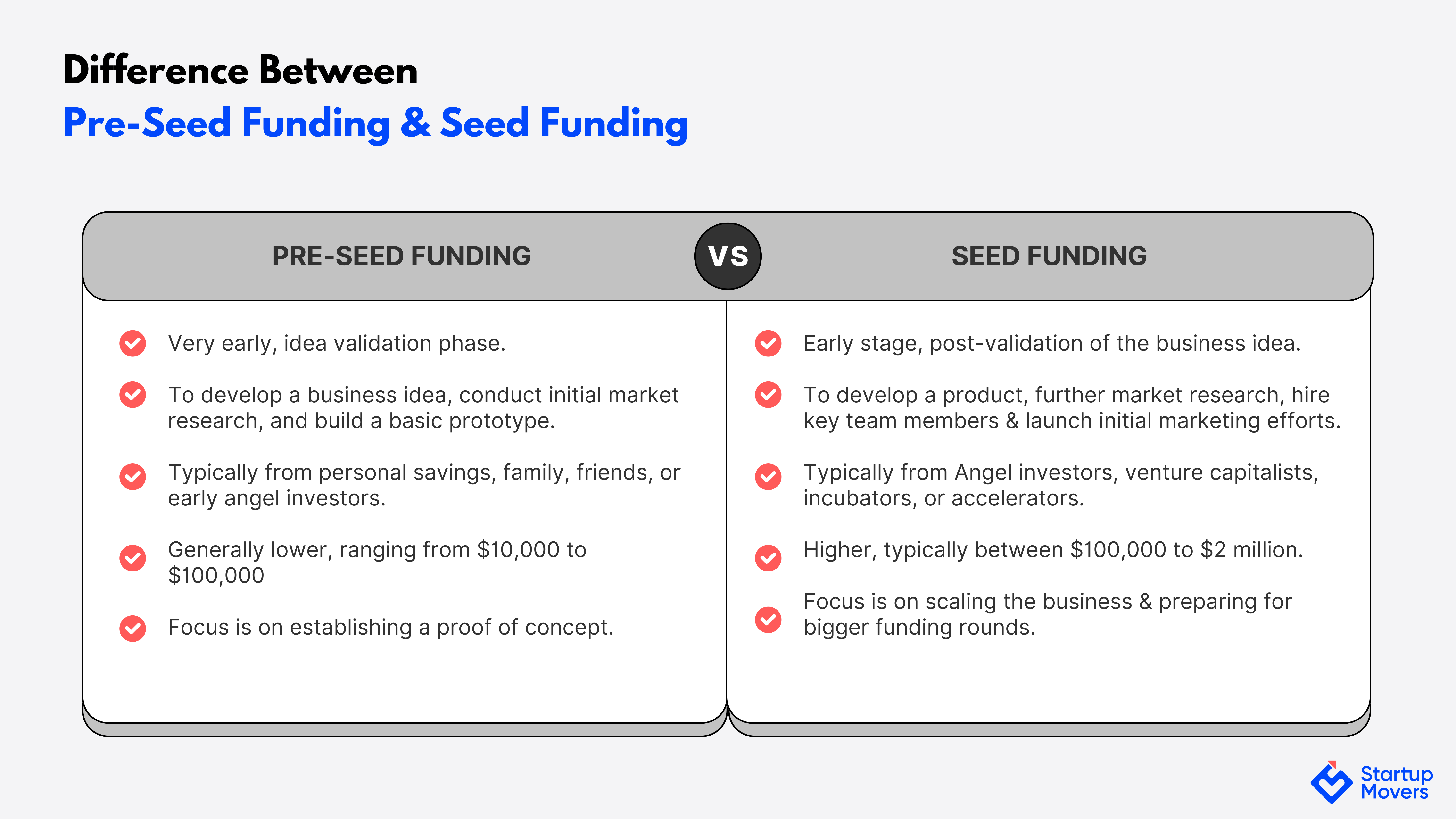

Understanding the differences between pre-seed funding in India and seed funding in India is crucial for startups to align their strategies and secure the right type of investment at each stage.

After securing initial capital through pre-seed and seed funding, startups often progress to Series A, Series B, and Series C funding rounds to fuel further growth and expansion.

To secure seed funding, investors often require robust financial modeling to assess a startup's potential. This section explores various funding avenues available in India, helping founders understand where and how to pitch their ideas effectively.

Raising seed funding in India comes with its own set of hurdles. Here are some common challenges:

Understanding these challenges can help you prepare and strategize more effectively.

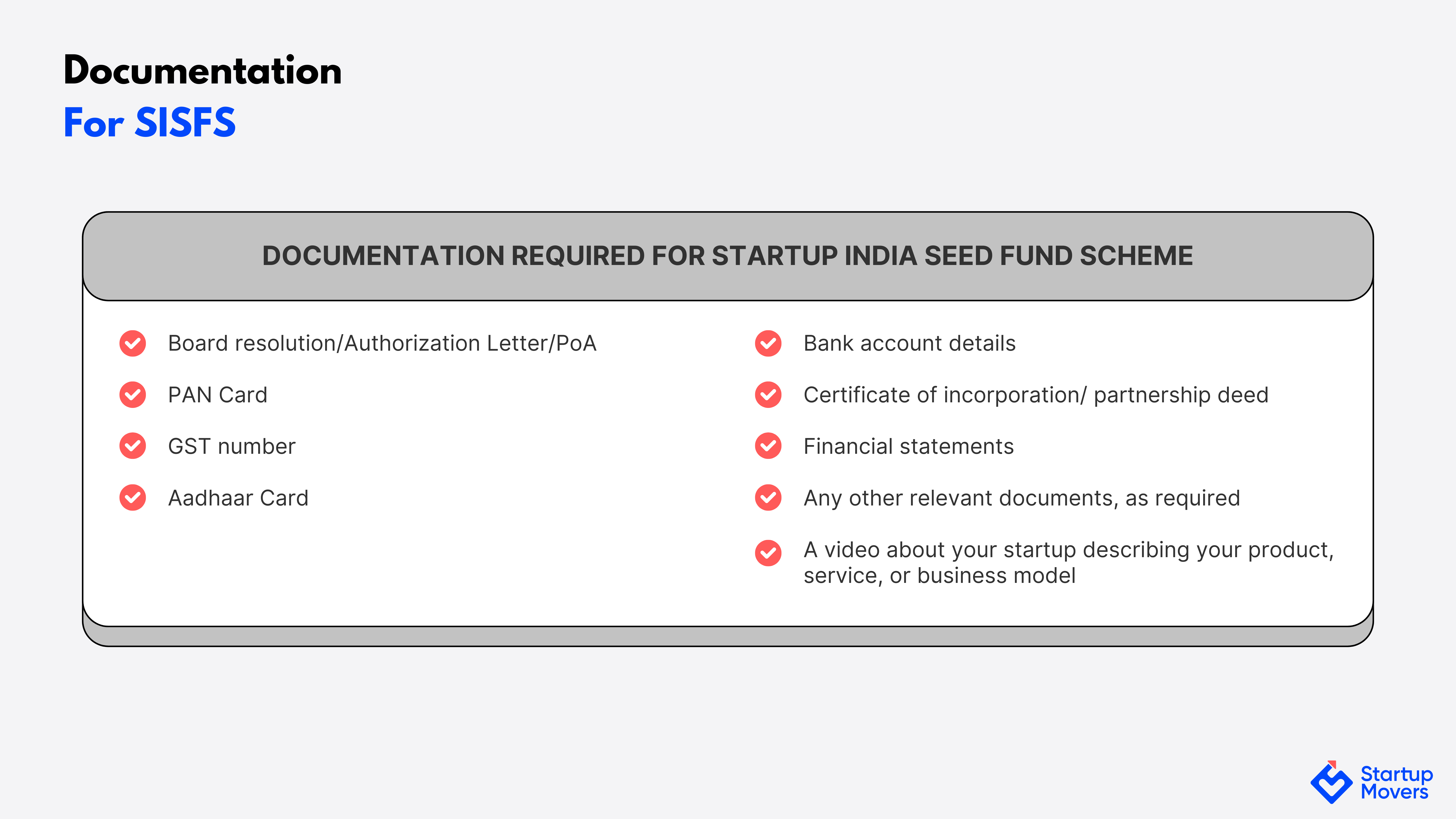

The Department for Promotion of Industry and Internal Trade (DPIIT) launched the Startup India Seed Fund Scheme (SISFS) with a budget of INR 945 Crore. This scheme provides financial support for proof of concept, prototype development, product trials, market-entry, and commercialization.

SISFS helps startups reach a level where they can attract investments from angel investors, venture capitalists, or secure loans from banks. If you are wondering how you can get funding from the government under SISFS, keep reading!

Who Is Eligible for Seed Fund Scheme?Your startup is eligible for SISFS if it meets all of the following requirements:

Apply Now to fuel your startup's growth! |

Note: Funds must be used strictly for the granted purpose and not for creating facilities.

For questions, refer to the FAQs section given below:

FAQsQ1. How do seed investors evaluate a startup's potential? Seed investors evaluate a startup's potential by assessing the business idea, market fit, scalability, team capabilities, and financial projections. They also consider the startup's ability to solve a significant problem using innovative solutions. Q2. Can a startup raise multiple rounds of seed funding? Yes, a startup can raise multiple rounds of seed funding. However, each round usually requires meeting specific milestones and demonstrating progress to attract additional investment. Q3. Can someone apply as an entrepreneur in SISFS? No, individual entrepreneurs cannot apply for support under the SISFS. Only startups recognized by DPIIT are eligible to apply for the scheme. |

Securing seed funding is crucial for startups in India. It provides the necessary capital, mentorship, and networking opportunities to turn ideas into successful businesses.

Understanding funding stages, choosing the right time to raise funds, and exploring various avenues help founders overcome challenges. The Startup India Seed Fund Scheme (SISFS) supports this journey, helping startups thrive. Founders, seize the opportunity, and drive your startup to success!

Access top-notch funding advice, valuation services, strategic guidance, and more.

Leave a Comment

Comments

No comments yet.

RECENT ARTICLES

Every Fundraising Term Founders Should Know (2025 Edition)

How to close a Registered Company? Step By Step Procedure!

GSTR-9 Annual Return: Complete Guide

Angel Syndicates in India (2025): How They Work for Early-Stage Founders?

Difference between Winding up and Strike off a Company

What is ESOP Meaning, Benefits & How do ESOPs Work?

Unlock Business Subsidy with PMEGP for Startups (2025)

AI Startups in India: Opportunities, Challenges & Compliance Guide (2025)